Every few years, investors and investors are changing. These time intervals are becoming increasingly shorter, with the numerous crises of recent times have contributed to a significant part.

After the collapse of cryptocurrencies and above all the collapse of the NFT bubble, alternative investment options are again sought in times of inflation and economic crisis. The stock markets are currently not very promising.

And the alternative of the alternative is told clumsily the return to the tried and tested. All kinds of arts are reliable these days as a reliable value memory and show their potential with positive value growth.

We have already dealt with art as an investment object in our contribution "Successful in art - art as an investment" . We would now like to continue these descriptions and current developments and investment opportunities . We also give you a small list with important do's and Dont's for a maximum success on your system.

The value of art

The value of art tends to not move in harmony with the stock market and can therefore serve to diversify the portfolio of an investor and offer real growth opportunities, especially in phases of the market weakness on the DAX, Dow Jones and Co.

Investing in art can offer a portfolio different advantages, but is also associated with certain inherent risks that you should know before you get into.

In the past, art could only be acquired on physical auctions or directly by the artist or owner. There are now countless opportunities to invest. There is the classic way of investing in which a physical work of art like a painting or a sculpture is bought or purchased at one of the many auction houses . In addition, there are now numerous ways to have a fraction of the total work of art, be it in digital or physical form.

Before you start, investors should decide which way, if at all, the best for you. physical art takes up space and may require more commitment than digital versions, but can also achieve higher returns if you choose properly. Art is considered an alternative system , and the system in this type of asset can often require different methods than the system in shares and bonds.

Why should you invest in art?

Before we take a closer look at the different options and examine their individual opportunities and risks, we should ask ourselves the most important questions right from the start: Why should you actually invest in art? And "Is art a suitable form of investment for you?".

First let's take a look at the value developments of the past :

Art market 1985 - 2018

A report published by Citibank showed that the returns of the art market corresponded to those of high-interest bonds from 1985 to 2018 and exceeded both shares from industrial and emerging countries.

In short, art exceeded other asset classes , but also suffered significant periods of volatility . Citi also emphasizes that contemporary art dated a whopping 56.8 percent during the recession in the early 1990s and about 28.5 percent during the great recession in 2008. During the Covid 19 pandemic, the market remained somewhat more resistant, probably because the market turbulence was short and this was followed by an stock market boom.

The Sotheby's Mei Moses Index is largely regarded by the industry as a reference to the changing demand in the global art market. In the past fifty years, this index showed an upward trend and gave investors confidence in the resistance and progress of the sector as a whole.

Source: Art Market Index Chart, by Sotheby’s

Since art is subjective, in addition to the objective performance, it also depends on how you look at it. Whether you consider art as a good investment option and pure investment or whether it is still a personal, emotional value for the owner.

In the case of rare individual pieces, the return of the piece can only be realized after successfully found a buyer. However, since there is a rather manageable number of interested parties, especially with expensive objects, the value to be achieved depends almost completely on the personal views of these people.

More traditional systems, such as stocks, have analyst teams at various companies on the free market that examine the value of a company and assign a value to this specific asset, which means that the value of a share is (mostly) more objective.

Investors are available for stocks and Co. a number of analysis strices with which you can make your investment decisions based. The same information level is (yet) not available in art

However, there have been recent developments such as the ALL Art INDEX mentioned to pursue the sales of high -ranking artists all over the world, but it is not yet the same objective process as the research -based analysis for publicly traded shares.

The American art curator and art market expert Moriah Alise made a name for herself on social media.

In the subsequent video contribution, she delivers razor-sharp analyzes and provides insider knowledge about the following subject areas:

- Understanding art market indices : What are art market indices and how do they work?

- Measurement of the market pulse : Learn to read "EKG"

- Reading market trends: How to navigate and understand through trends what increases the "value" of an artist in this competitive area.

- Art as diversification: Discover how art can be more than just an aesthetic pleasure - it is a strategic asset class that gives your investment portfolio balance.

- Forecasts for the future (predictive insights) : take a look into the future while we discuss how big data and machine learning change the way we approach art collections.

For collectors and artists alike, this video is a gold pit of knowledge.

The range of number -based analysis tools and consulting services for art trade continues to increase rapidly.

Promising developments by 2021

2021 was a turbulent year in the investment world, in which the effects of global pandemic reached every market. the market for contemporary art has proven to be exceptionally resistant, with persistent success and record results, despite challenges that are observed elsewhere.

The market for art as an investment was even able to continue its growth course. The interest of investors continued to increase in sustainable investments and new technologies. These are the central results of the 7th Art & Finance Report 2021 by Deloitte and Artactic .

the high-net-word individuals (HNWI) particularly relevant to art trade has more than quadrupled to around $ 191.6 trillion. The assets created in art were $ 1,481 billion in 2020.

Source: 7. Deloitte Art & Finance Report 2021

According to the Deloitte consultants, this number could continue to grow to $ 1,882 billion according to the forecasts of the Deloitte consultants.

2022 - 2024: Status quo & current trends

The youngest figures for the global art market come from the 2024 Contemporary Art Market Report by Artprice.com .

The annual market report in the 18th edition provides us with important key knowledge to interpret the challenges, perspectives and current developments. This is done on the basis of an in -depth analysis of the art auction sales of over 33,000 artists worldwide, which took place from July 2023 to June 2024.

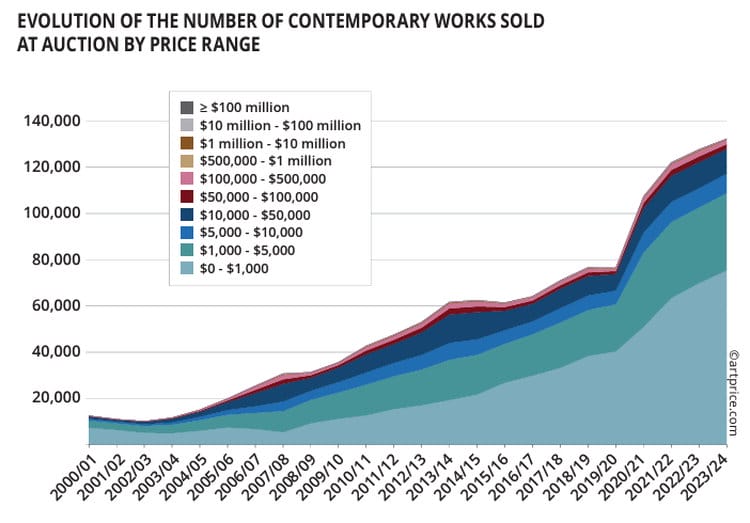

Driven by a record number of transactions and the goal of making auction sales more accessible, the market for contemporary art has developed a broader basis below the $ 10,000 brand. This leads to more stability and resistant structures against crises and market fluctuations.

The increased purchase interest is increasingly aimed at the variety of artistic work and is reflected in the growing appreciation for artists and new media such as digital creations.

In addition, the art market becomes more democratic through online sales by offering new participants numerous options. This development promotes shorter holding time of works of art that are subject to faster circulation.

Works by young, ultra -time genetic artists such as Jadé Fadojutimi, Lucy Bull and Louis Sister are already celebrating success on the second market. ”

So Thierry Ehrmann , CEO and founder of Artprice by Artmarket.com

As the second current data source, we can the Art Basel and UBS Survey of Global Collecting 2024, .

The report represents the most comprehensive examination of this kind to date and provides valuable insights into the buying behavior and the transfer of assets between the generations of wealthy private individuals, especially against the background of challenging economic conditions.

In this issue, the opinions of over 3,500 of such collectors from 14 international markets were recorded, with new participants from Switzerland, Mexico and Indonesia being included.

The author of the report, the cultural economist Dr. Clare Mcandrew , is supported by Paul Donovan , the chief economist at UBS Global Wealth Management , as well as Noah Horowitz , the CEO of Art Basel .

In keeping with this, there was a panel discussion with the authors:

Here the 6 most important findings of the survey are summarized for you:

- HNWIS (High net Worth individual) are optimistic in a demanding market: the expenditure in the first half of 2024 indicates stabilization, and 91 % of the HNWIS surveyed were positive about the development of the global art market in the next six months compared to 77 % at the end of 2023.

- Signs of stable expenses: The average editions of the HNWIS surveyed for art and antiques in the first half of 2024 (at $ 25,555), provided they serve as an indicator for the second half of the year, could reflect a constant annual level of expenses.

- Buying new galleries: In the years 2023 and 2024, HNWIS showed a pronounced willingness to buy in new galleries, whereby 88 % of buyers worked at a new gallery at least once.

- Support for new and aspiring artists: HNWIS invested 52 % of their editions in works by new and up -and -coming artists, 21 % of which in the middle of their career and 26 % of established artists (of whom were the majority were artists were).

- A strong return of expenses after the Lockdown on the Chinese mainland continues: The 300 Hnwis surveyed on the Chinese mainland reported in 2023 and in the first half of 2024 of average editions for art and antiques of $ 97,000, which is the highest expenses among all respondents. This amount was more than twice as high as in any other region that was examined in the first half of the year, followed by France ($ 38,000), Italy ($ 32,000), Great Britain (USD 31,000) and Hong Kong ($ 28,000).

- Agency of impulsive purchases and an increase in the collection of artists: Pulse purchases decreased from 10 % in 2023 to only 1 %, while the respondents increasingly carried out background research before buying. The proportion of works by female artists in the examined HNWI collections with a ratio of 44 % and male artists has achieved the highest level in seven years.

Source: 6 Insights from the Art Basel and UBS Survey of Global Collecting 2024

The art market is as large as attractive: with 14 percent on average annual return, it has constantly outperformed the US S&P 500 share index since 1995.

Global art market: annual performance 1995-2020

Source: 7. Deloitte Art & Finance Report 2021

Art has become an integral part of asset management over the past decade.

What began ten years ago with a first examination of the role of art as an investment in asset management by Deloitte has gained considerably over the years.

Today, most asset managers have long since recognized the importance of art and collectors as strategic components of their holistic asset management.

According to the results of the current report, 85% of asset managers, 76% of collectors and 96% of the art market experts surveyed are of the opinion that art should be an integral part of WEATTH Management Services.

Source: 7. Deloitte Art & Finance Report 2021

Likewise, the recognized Artprice100 © index only one direction and rose by fabulous +36%last year (2021).

Thierry Ehrmann , CEO and founder of artmarket.com commented on this as follows:

We are very proud to have played a leading role in the process of democratizing the art market for 25 years. Subject to an elite group of connoisseurs by the end of the 20th century, the art market is now accessible to a much larger number of people. Our services offer affordable information that can be called up anywhere and unlimited and updated every hour. With our added value data, art professionals and artists can buy and sell extraordinary and family works in peace. "

Evaluation of the inherent risks: the approach of artmarket.com

Again and again the art world is shaken by a sensational story. From the discovery of a gymnast in the junk of a flea market to the sudden increase in value of a self -destructive Banksy at the end of his sale ... There seem to be many different ways to make a significant profit at the art market.

But in reality these sensational stories remain exceptions, and for each of them, tens of thousands of works change the owner every year in much more discredited and quieter way.

How can uncertainty be reduced?

Risk in the financial sense is an integral part of every investment form, and art is no exception here; quite the opposite. Fortunately, this risk can be partially checked in different ways , especially by knowing how to recognize the value of a work and by buying at the best price.

The buyer who dared Christopher Wools "Untitled" (1990) in 2000 for $ 35,250 completed an extraordinary transaction by resold it fifteen years later for $ 2,405,000.

Nevertheless, this investment was associated with considerable financial risks, which were associated with a high degree of uncertainty. The increase in the works of Christopher Wool mainly began after the 2008 financial crisis, as the price index for original works of this artist calculated by Artprice shows.

In fact, a collector who bought a painting (or a drawing) from Christopher Wool would have benefited almost as much from Wool's success shortly after he had joined the Galleries Gagosian and Simon Lee , but without taking the same risks as the buyer who did in 2000.

Source: Artprice.com

Another proven investment strategy lies in the diversification , which sounds the more promising, the more power works under $ 50,000 on the market.

Source: 2024 Contemporary Art Market Report, Artprice.com

While the sector for affordable works of art experiences an upswing, the price segment stands out between $ 5,000 and $ 10,000 due to its durability and accounts for 6 % of the entire transactions.

At the same time, the results in the range of $ 10,000 to $ 50,000 had a remarkable dynamic and opened the chance to acquire some of the most dynamic works of contemporary art.

How to invest in art

There are different ways that an investor or investor can take to invest in art, be it physically or digital.

Physical: The classic approach is to invest in physical art. This can be done via galleries and auction houses (think of Christie’s or Sotheby’s , two traditional auction companies) both personally and online.

Here you will find a work of art that you consider to be a worthwhile investment and buy the whole thing directly.

Digital/NFTS: Not fungible tokens or NFTS are a way to digitally invest in a work of art and to receive a documentation of ownership via a safe blockchain.

With the purchase of a NFT you can have a digital work of art, but an NFT can really be everything - from a work of art to a song to a written work.

Art is not necessarily a painting or picture, and NFTs enable investors to have a wide range of digital art stocks without ever getting in touch with them physically. They can then be traded and sold on the free market.

Marketplace sites : Specialized online platforms such as master works , arttrade , or those in Maddox Gallery London enable the purchase of fraction of art states.

This is perfect for investors who want to get their feet wet but are not yet willing to commit themselves to buy a whole piece. The company acquires the work of art, gets it (so that practically everyone can invest) and sells it when the right time has come.

Investors can achieve a return as soon as the piece is sold.

Masterworks also offers a secondary market platform to provide liquidity for the purchase and sale of works of art, similar to NFTs (minus the blockchain). Investors can also buy and act shares as they would do with other tradable assets.

Shares, ETFs and investment funds : There are no classic stocks or ETFs and investment funds for art, but there are funds geared towards art tactics, such as that of a company called Yieldstreet .

For example, investors can invest in a portfolio of 10-20 works of art via their Art Equity Fund II This special focuses on artists influenced by art in Harlem, New York.

Art tactics funds work similarly to normal equity funds because they have a fund manager and raise an administrative fee, but investors have to wait until (and if) the pieces are sold to achieve a return.

You can find out more details about the investment options, including your opportunities and risks, in our article mentioned at the beginning "Successful invest in art - art as an investment" .

Short guide for the purchase of art as an investment

1st up -and -coming/young artist

Although it is important that you direct your resources to the investment in well -known and widely accepted works, you may also want to check the work of aspiring artists. India's up-and-coming top artist are a sample worth seeing .

While the risk is higher, the return opportunities in the event of a direct hit are much more worthwhile if the artist you selected comes out. It's a little like gambling. So consider this to be a very speculative form of investment (roughly comparable to options).

It is advisable not to invest all of your means in aspiring artists and better to strive for a good mix .

2. Concentrate on a category

Choose an art category or a painting style that suits you the most. Concentrate on studying one category instead of shopping indiscriminately, which you spontaneously address.

The more you concentrate on a category (nature, still lifes, abstraction, mythology, etc.), the greater your chances of making the right decisions in the long run.

3. Start small

Do not rush your investment. Share your budget as much as you want to spend every year. Stick to these specifications. This strategy also gives you enough time to estimate market reactions.

4. Keep up to date with the latest trends

Find out more about international trends. Most information is available online. As soon as the demand for a certain genre of art gains dynamics, they offer your investment for sale.

5. Be steadily and negotiate

Make a fair offer when buying and wait. If the work of art is available at your specified price, you will receive it. If it gets more expensive, it may no longer be worth buying it at this price. Better look instead.

Also be rigorous when selling your pricing.

DOS

Remember - investing in art is a long -term investment option. Stay patient and will pay off.

Research well. Make sure you check the origin of the painting/artwork. Do not only assume what the dealer or the auction house has to share. Connect directly to the artists if you can.

Ask the dealer/auction house as many questions about the painting/artwork. Only drive away when all your doubts and questions have been clarified.

Little

Don't let yourself be carried away by the price. If there is a price that is far lower compared to what your estimate shows, check the authenticity. Check whether it was bought lawfully, stolen or illegally brought into the country.

Do not put your credibility at all costs. Ask for export licenses before buying when it comes to international work.

Don't forget the insurance documents. Find out more about the insurance options offered.

Do not neglect works of art even after their purchase. Maintain and protect your acquired art well.

Owner and managing director of Kunstplaza. Publicist, editor and passionate blogger in the field of art, design and creativity since 2011. Successful conclusion in web design as part of a university degree (2008). Further development of creativity techniques through courses in free drawing, expression painting and theatre/acting. Profound knowledge of the art market through many years of journalistic research and numerous collaborations with actors/institutions from art and culture.